401k tax penalty calculator

Using this 401k early withdrawal calculator is easy. Strong Retirement Benefits Help You Attract Retain Talent.

What Is The 401 K Tax Rate For Withdrawals Smartasset

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

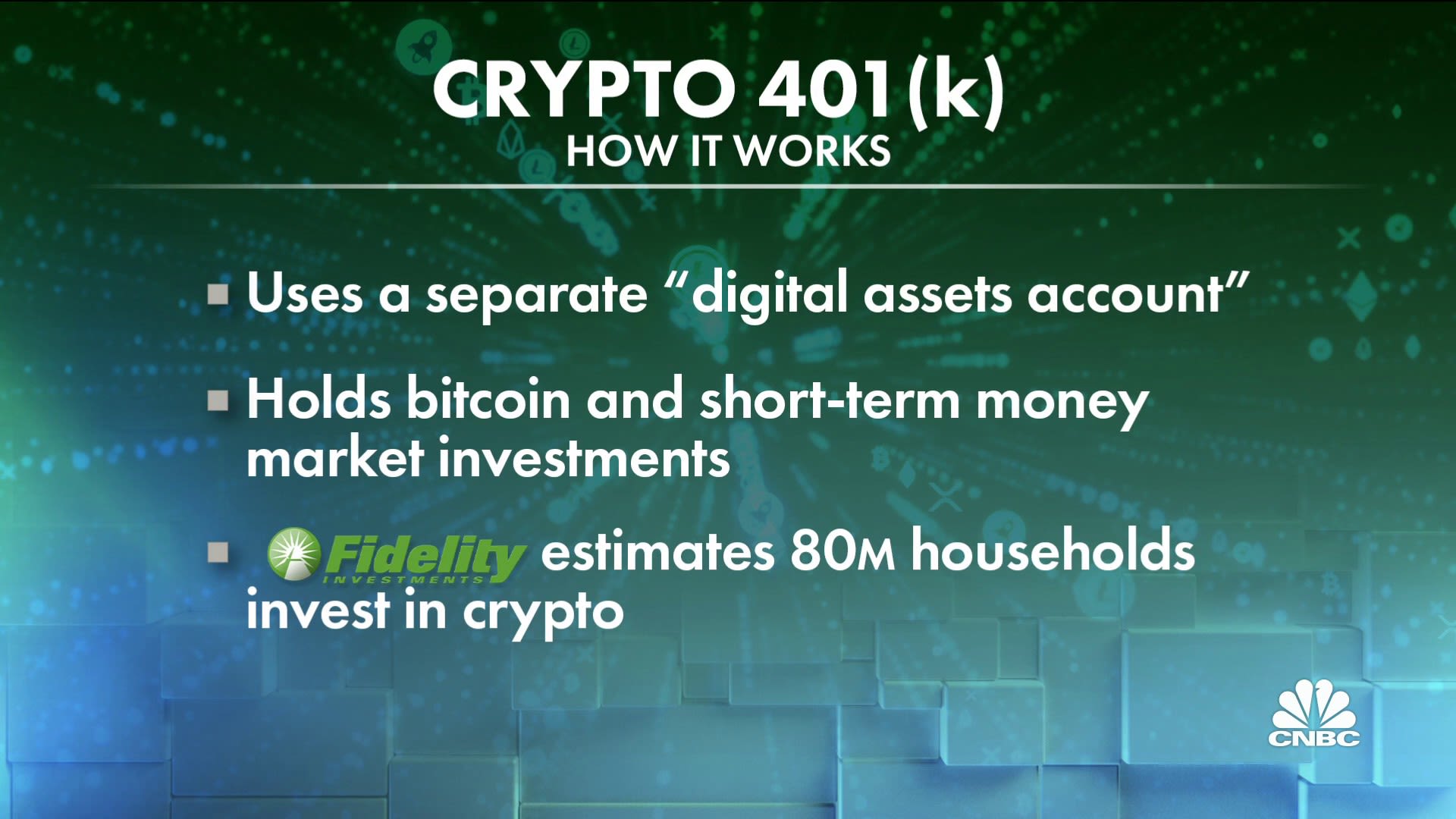

. TIAA Can Help You Create A Retirement Plan For Your Future. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax obligation.

Both have significant limitations but they can potentially let you tap your 401k without paying. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax. Protect Yourself From Inflation.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if you. Dont Wait To Get Started. So if you take 20000 out of your 401 k before you reach 59 12 youll.

Open an IRA Explore Roth vs. How do taxespenalties calculate on a retirement loan that defaulted. If you are under 59 12 you may also be.

Ad 10 Best Companies to Rollover Your 401K into a Gold IRA. Our IRS Penalty Interest calculator is 100 accurate. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo.

We have the SARS tax rates tables. Interest increases the amount you owe until you pay your balance in full. The money you withdraw from your 401k is taxed at your normal taxable income rate.

Ad Make a Thoughtful Decision For Your Retirement. We calculate the amount of the Underpayment of Estimated Tax by Individuals Penalty based on the tax shown on your original return or on a more recent return that you filed. 100 Employer match 1000.

For example if you are looking. So if you withdraw the 10000 in your 401 k at age 40 you may get only. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

In some cases its possible to withdraw from retirement accounts like 401 ks and individual retirement accounts before your retirement age without a penalty. As mentioned above this is in addition to the 10 penalty. If you start taking money out of your 401 k early youll pay taxes of 20 percent of what you withdraw.

Ad If you have a 500000 portfolio download your free copy of this guide now. Our sole and only guarantee or warranty. Traditional or Rollover Your 401k Today.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Ad Looking for 401k tax rate calculator. The date from which we begin to charge interest varies by the type of penalty.

Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want. The IRS generally requires automatic withholding of 20 of a 401 k early withdrawal for taxes. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds.

Loan amount is 44kDoes the IRS add tax onto 44k and then I get a 10 penalty based on that. The 401k rollover and the 401k loan are the two methods that you can use. Underpayment of Estimated Tax Penalty Calculator.

Find updated content daily for 401k tax rate calculator.

Pin On Buying Selling A Home

:max_bytes(150000):strip_icc()/dotdash_Final_Rolling_Over_Company_Stock_When_It_Does_and_Doesnt_Make_Sense_Nov_2020-01-d8564a6c9cc44d5aa668960b689881bc.jpg)

Rolling Over Company Stock When It Does And Doesn T Make Sense

Do You Have To Report 401k On Tax Return It Depends

Choice Between Pre Tax And Roth 401 K Plans Trickier Than You Think

Iras 401 K S Other Retirement Plans Strategies For Taking Your Money Out By Twila Slesnick Phd Enrolled Agent Nolo Retirement Planning Money Book Enrolled Agent

/dotdash_Final_Rolling_Over_Company_Stock_When_It_Does_and_Doesnt_Make_Sense_Nov_2020-01-d8564a6c9cc44d5aa668960b689881bc.jpg)

Rolling Over Company Stock When It Does And Doesn T Make Sense

After Tax 401 K Contributions Retirement Benefits Fidelity

401k In Divorce A Tip That Can Save You Thousands

This Infographic Tells You Which Debts You Want To Pay Down First And Why

401k Calculator

401 K Plan What Is A 401 K And How Does It Work

Irs Fresh Start Program How Does It Work Infographic Irs Fresh Start Program Work Infographic

/dotdash_Final_Rolling_Over_Company_Stock_When_It_Does_and_Doesnt_Make_Sense_Nov_2020-01-d8564a6c9cc44d5aa668960b689881bc.jpg)

Rolling Over Company Stock When It Does And Doesn T Make Sense

2022 Retirement Plan Withdrawals Calculator Calculate Early Withdrawal Income Tax Penalties On Your Ira Or 401k Retirement Savings Plan

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

2020 After Tax Contributions Blakely Walters

Joe Biden Promises To End Traditional 401 K Style Retirement Savings Tax Benefits What S That Mean